New Asia Bank

Others taking part tend to be Uzbekistan, Thailand, Sri Lanka, Qatar, Pakistan, Nepal, Bangladesh, Brunei, Kazakhstan, Kuwait, Malaysia and Myanmar.

Others taking part tend to be Uzbekistan, Thailand, Sri Lanka, Qatar, Pakistan, Nepal, Bangladesh, Brunei, Kazakhstan, Kuwait, Malaysia and Myanmar.

Just as essential is that's perhaps not into the group: Solid American allies Japan, South Korea and Australia, even though they, combined with U.S. may enter at a later date if venture demonstrates become a success. Although Singapore is a close U.S. ally, its officials say entering now can give them the opportunity to make an optimistic affect the way the lender plans to work.

— JUST WHAT EXACTLY'S WASHINGTON'S VIEW?

The U.S. can be involved the new lender will introduce laxer standards for lending with regards to ecological and work protection, transparency regarding the project putting in a bid procedure, and personal liberties. Washington concerns that could undercut existing organizations like the World Bank, the International financial Fund in addition to Asian developing Bank having sought to enforce requirements to advertise great governance, fair work techniques and a clean environment.

Normally, Washington can be concerned about any move by China to move interest from organizations that it and its allies take over. The world's first and second biggest economies deeply distrust each other and are locked in a ceaseless competition for pre-eminence in Asia, where the U.S. is the dominant military power but China's massive economy carries enormous heft.

— SIMPLY HOW MUCH DID IT LEND?

— SIMPLY HOW MUCH DID IT LEND?

China says it is ready to pony up almost all for the billion to capitalize the financial institution, while various other establishments and exclusive loan providers are expected to supply another billion. That 0 billion continues to be relatively little compared with current establishments. The planet Bank's money is all about $220 billion, while the Asian Development Bank has actually $175 billion capital.

However, China seems inclined to streamline the financing procedure, meaning nations may not have to wait patiently as long or jump through as much hoops to have their funds. That may stimulate borrowing all-around if it ultimately ends up contending with existing establishments for company.

— WHAT'S INSIDE FOR CHINA?

The financial institution is within large part Asia's response to being continuously directed to second-class status at existing organizations. China is also supporting another alternate establishment, the newest Development Bank, sponsored by the alleged BRICS countries which also consist of Russia, India, Brazil and South Africa.

The idea usually in the event that U.S. and other significant abilities will not make enough space for Asia at dining table, after that Beijing will likely make unique. China also hopes the bank will improve its international stature and end what it views while the western's intimidation and discrimination into the governmental and financial spheres.

The idea usually in the event that U.S. and other significant abilities will not make enough space for Asia at dining table, after that Beijing will likely make unique. China also hopes the bank will improve its international stature and end what it views while the western's intimidation and discrimination into the governmental and financial spheres.

Besides, the bank is expected to create solid economic advantageous assets to Asia, whoever companies already benefit massively from plan loans offered abroad by the country's state finance companies. They are able to expect to get interface, railroad and telecommunications agreements for tasks linked with Asia's oft-mentioned dream of rebuilding old Silk Road trade backlinks to Europe. The bank could also take in a number of China's $3.89 trillion in forex reserves.

— WHAT WANTED PERFORMS IT OFFER?

Asia requires infrastructure development. Countless it. The planet lender estimates that $8 trillion in spending is necessary between 2010 and 2020 just to keep Asian economies humming along. Just a tiny piece of that are now able to be supplied by the Asian developing Bank and other institutional lenders, so that the AIIB hopes to help to fill some of those enormous gaps.

At the least, the AIIB must provide borrowers more options and might put pressure on the World Bank yet others to improve their particular heavily bureaucratic functions, which often simply take many years to process loan requests. By its multinational nature, it might additionally pressure Asia's finance companies to shape-up their particular businesses and help defray a number of the resentment which has built up toward Beijing among consumers which feel burned by the regards to their financial loans from Chinese state banking institutions.

"In Asia we a people saying. If you'd like to get rich, create roadways first, and I believe is an extremely vivid information of the very importance of infrastructure to financial development, " Chinese President Xi Jinping told participants after the signing ceremony.

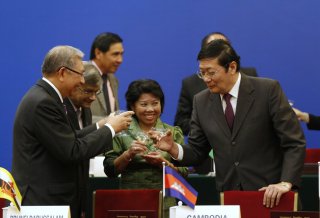

Chinese President Xi Jinping, front center, poses aided by the other federal government leaders in addition to friends just who went to the signing service of Asian Infrastructure Investment Bank on Great Hall of those in Beijing Friday, Oct. 24, 2014. Asia and 21 various other Asian countries have actually finalized on to the brand new intercontinental lender compared by Washington as an unnecessary competitor to founded institutions including the World Bank.(AP Photo/Takaki Yajima, Pool)

Chinese Finance Minister Lou Jiwei gives a speech throughout the signing service of the Asian Infrastructure Investment Bank on Great Hall of the People in Beijing Friday, Oct. 24, 2014. Asia and 21 various other Asian nations have finalized onto the brand-new worldwide lender opposed by Washington as an unnecessary opponent to set up organizations like the World Bank.(AP Photo/Takaki Yajima, Pool)

RELATED VIDEO

Share this Post

Related posts

China New Asia

Chinese Finance Minister Lou Jiwei (remaining) talks during the signing service associated with Asian Infrastructure Investment…

Read MoreNew LED Lighting products

These lamps, light sources, and luminaires round out of the latest products to incorporate Light-emitting Diode technology…

Read More